China’s top battery maker is planning to sell $9 billion in stock to help boost its manufacturing capacity, capitalizing on a boom in electric vehicles and investor optimism over the industry’s future.

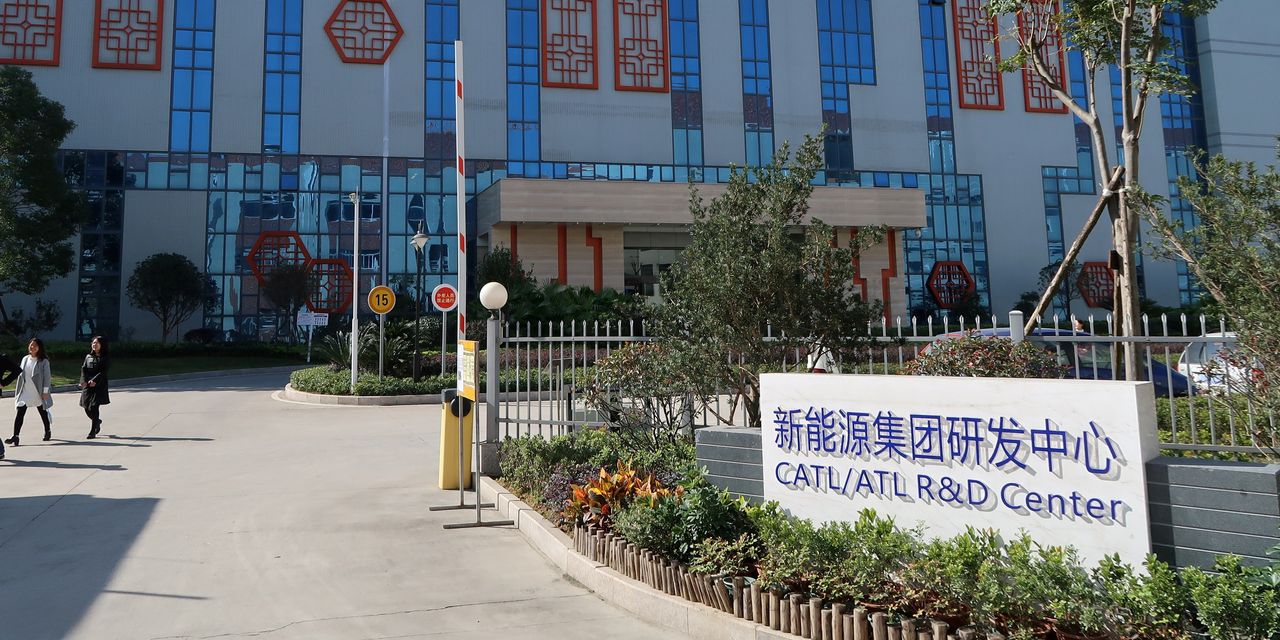

Contemporary Amperex Technology Co. , one of the world’s largest makers of lithium-ion batteries, said Friday it expects to raise up to 58.2 billion yuan, equivalent to $9 billion, via a share placement to large investors. The nearly decade-old company, also known as CATL, is a major supplier of batteries to Tesla Inc.’s Shanghai factory.

CATL’s Shenzhen-listed shares have climbed more than 150% over the past year and hit a record high earlier this month. The company, which is based in China’s southeastern Fujian province, has enjoyed robust sales growth from local electric-vehicle makers and recently signed deals with Tesla and other auto makers.

Its market capitalization was about $180 billion as of Friday, according to FactSet, making it one of the most valuable companies listed in mainland China. CATL’s stock-price rally has also far outpaced rival battery makers Panasonic Corp. of Japan and LG Chem Ltd. in South Korea.

The latest share sale comes a little over a year after CATL raised the equivalent of $3 billion in a private stock sale. Buyers in this round will include up to 35 investors from asset-management and insurance companies, as well as other financial institutions, the company said.