Intel Corp.

INTC -11.68%

disappointed investors even as it posted stronger third-quarter earnings as component shortages weighed on computer shipments and China’s crackdown on computer gaming hurt server-chip sales.

Intel, which powers many personal computers, Thursday reported third-quarter sales of $19.2 billion, up 5% from the year-ago period, generating net income of $6.8 billion. Adjusted sales, stripping out revenue from memory operations Intel is selling to South Korea’s SK Hynix Inc., came in at $18.1 billion, below the $18.2 billion Wall Street forecast.

Intel shares, which closed Thursday up 1.14%, fell more than 8% in after-hours trading on the results.

Analysts, ahead of results, warned PC sales would suffer because parts shortages held back computer sales.

Intel Chief Executive Pat Gelsinger said there are “inventory challenges and supply challenges” for power controllers and Ethernet components that are limiting its customers’ ability to shop for more laptops and servers despite a big backlog.

Sales fell 10% for the unit that includes chips that go into notebooks. The impact was offset partly by strength in Intel’s desktop business and higher prices amid strong demand as vendors shipped higher-value devices.

The chip maker said sales in its data-center unit rose 10% to $6.5 billion, in part driven by the recovery from the economic effects of the pandemic. The result fell short of Wall Street forecasts, though.

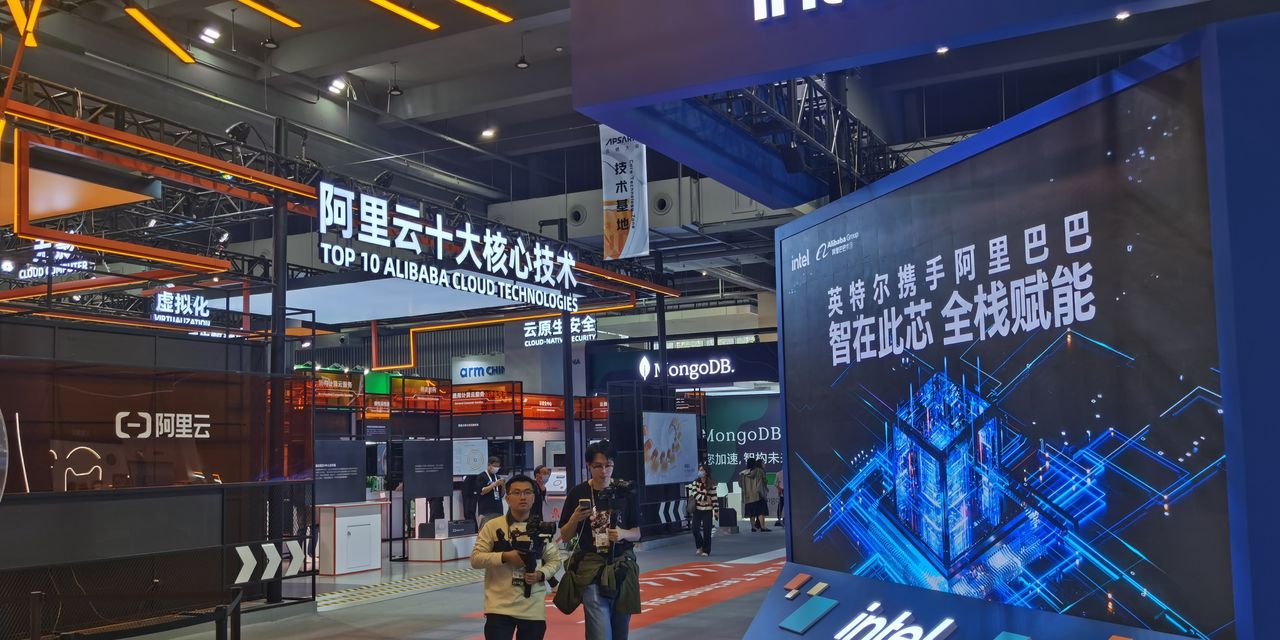

Mr. Gelsinger said some data-center customers serving China’s videogaming market were adjusting their business after the country began a crackdown on the time children spend playing videogames. China in August said it was imposing limits on young gamers to fight what it characterized as a youth videogame addiction.

“We do expect that will recover,” Mr. Gelsinger said.

The chip shortage should slowly start improving next year, Mr. Gelsinger said, even as he stuck with his projection it would possibly drag into 2023.

The lag between a company ordering a chip and its delivery has soared to an average of 22 weeks, said Susquehanna analyst Christopher Rolland, adding that the duration is the longest since he started tracking the data in 2013.

Mr. Gelsinger last month pledged to invest up to $95 billion in new chip production capacity in Europe, adding to more than $20 billion in U.S. factory investments he detailed earlier as Intel tries to cater to increased demand for semiconductors and become a leading contract chip maker.

Taiwan Semiconductor Manufacturing Co.

, the world’s leading contract chip maker, this month said it would build a new chip-manufacturing plant in Japan, and

Samsung Electronics Co.

and memory-chip maker

Micron Technology Inc.

are among others with expansion plans.

To provide some near-term relief, Mr. Gelsinger has said Intel is working with auto makers that have been particularly hard hit by the shortage. The company, he said, would dedicate manufacturing capacity at one of its factories in Ireland to the auto-chip sector and is creating a chip-design team to help others adapt their designs to be able to use Intel’s manufacturing capabilities.

Intel, for the current quarter, said it expects sales of $19.2 billion. Wall Street is forecasting sales of $19.4 billion in the period. Full-year sales should reach $77.7 billion, Intel said.

Intel also said Chief Financial Officer George Davis plans to retire in May. The company said it was shifting an investor day planned for November to next year to await the arrival of a new financial chief.

Mr. Davis, on the call, said adjusted sales next year should reach at least $74 billion, above analysts’ expectations, with revenue growth accelerating in subsequent years. Profitability, he said, would affect margins over the next two to three years as the company invests before growing again. Capital expenditure could reach $28 billion in 2022, he said, and potentially increase further in following years.

Corrections & Amplifications

Intel shares closed Thursday up 1.14%. An earlier version of this article incorrectly said Wednesday. (Corrected on Oct. 21)

Write to Meghan Bobrowsky at Meghan.Bobrowsky@wsj.com

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8