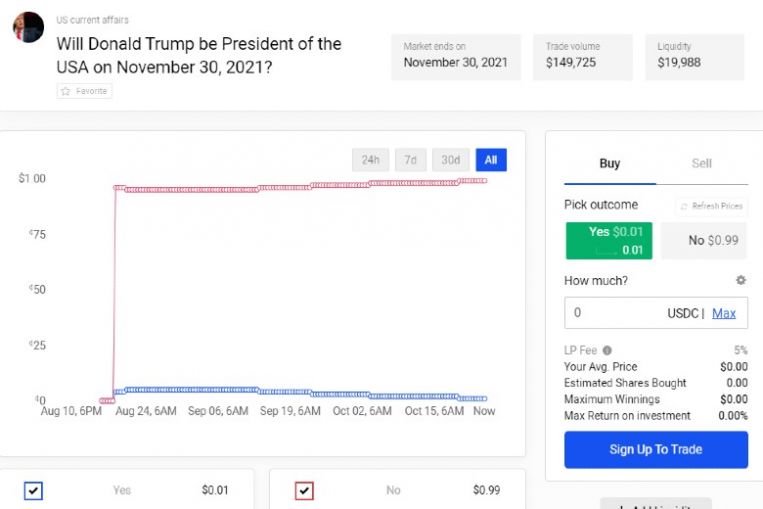

WASHINGTON (BLOOMBERG) – It is the go-to place for making crypto wagers on whether former president Donald Trump retakes the White House and celebrities Jennifer Lopez and Ben Affleck get engaged. It is also under scrutiny by a top Wall Street regulator.

The firm is Polymarket – a New York-based platform that has surged in popularity during the Covid-19 pandemic as a way for bettors to predict the outcomes of real-world events, including elections, ballgames and the private lives of celebrities.

The problem? It may be breaking United States financial rules.

The Commodity Futures Trading Commission (CFTC) is investigating whether Polymarket is letting customers improperly trade swaps or binary options and if it should be registered with the agency, according to people familiar with the matter.

“Polymarket is firmly committed to complying with applicable laws and regulations and to providing information to regulators that will assist them with any inquiry,” a spokesman for the firm said.

The CFTC declined to comment.

Led by 23-year-old founder Shayne Coplan, Polymarket is hot, facilitating some four billion shares since launching last year.

The company has been in talks with investors on a new round of funding that could value it at almost US$1 billion (S$1.35 billion), according to two people with knowledge of the matter who asked not to be named because the discussions are private.

As at Friday afternoon (Oct 22), Polymarket featured dozens of possible wagers, ranging from whether the Treasury Department will mint a US$1 trillion coin by Nov 5, to singer Nicki Minaj getting the Covid-19 vaccine by Nov 29 and Mr Elon Musk’s SpaceX reaching outer space by year’s end.

Customers favour no Treasury coin, Ms Minaj remaining unvaccinated and SpaceX coming up short.

While the CFTC is best known for policing banks’ derivatives desks and oil traders, it has long been grappling with how to regulate event contracts like those offered by Polymarket.

Amid tough questions from the CFTC, cryptocurrency exchange ErisX withdrew a proposal in March to offer futures contracts based on National Football League games, products that casinos could have used to hedge their sportsbooks.

Crucial to Polymarket is another asset class of the moment: crypto. Instead of US dollars, customers who want to make trades have to use the USD coin, a so-called stablecoin backed by Coinbase Global.

Stablecoins, whose values are pegged to fiat currencies, have gotten a lot of attention themselves from Washington in recent months.

Government agencies, including the CFTC, are concerned the largely unregulated tokens have grown so big that they could put consumers at risk or threaten financial stability if Bitcoin and other cryptocurrencies crashed.

The market value of USD coin is now US$32.4 billion, up from US$3.9 billion at the end of last year, according to CoinMarketCap.com.

A coin issued by Tether has grown to almost US$70 billion from US$21 billion over the same time period, making it the largest US stablecoin.

CFTC investigations do not always lead to enforcement cases and Polymarket has not been accused of wrongdoing. If firms are sanctioned by the regulator, they can face fines and restrictions on offering products.

To handle the probe, Polymarket has retained law firm Sullivan & Cromwell partner James McDonald, who was head of the CFTC’s enforcement division until last year, said a person with knowledge of the hiring. Mr McDonald did not respond to a request for comment.

Polymarket has said it is not only offering bettors a destination to make money, or lose their shirts. In an age of disinformation and fake news, the company argues it is providing useful data on what is likely to happen in the not-so-distant future on geopolitics and other important topics.

“Via price discovery, you get this perpetually accurate forecast about the future of a given event,” Mr Coplan said last year on the Star Spangled Gamblers podcast. “This is something that could have tremendous social value.”

Polymarket does not take custody of money or digital tokens, and it just displays existing markets live on the Ethereum blockchain, according to its website.

The firm also does not take the other side of customer trades. In a sign of the high interest, a separate website called “Polymarket Whales” has popped up that features the biggest bettors on closely watched contracts.