Inventory futures are rising, placing Wall Avenue on target to stabilize after final week’s Omicron-variant selloff. Right here’s what we’re watching in Monday’s buying and selling:

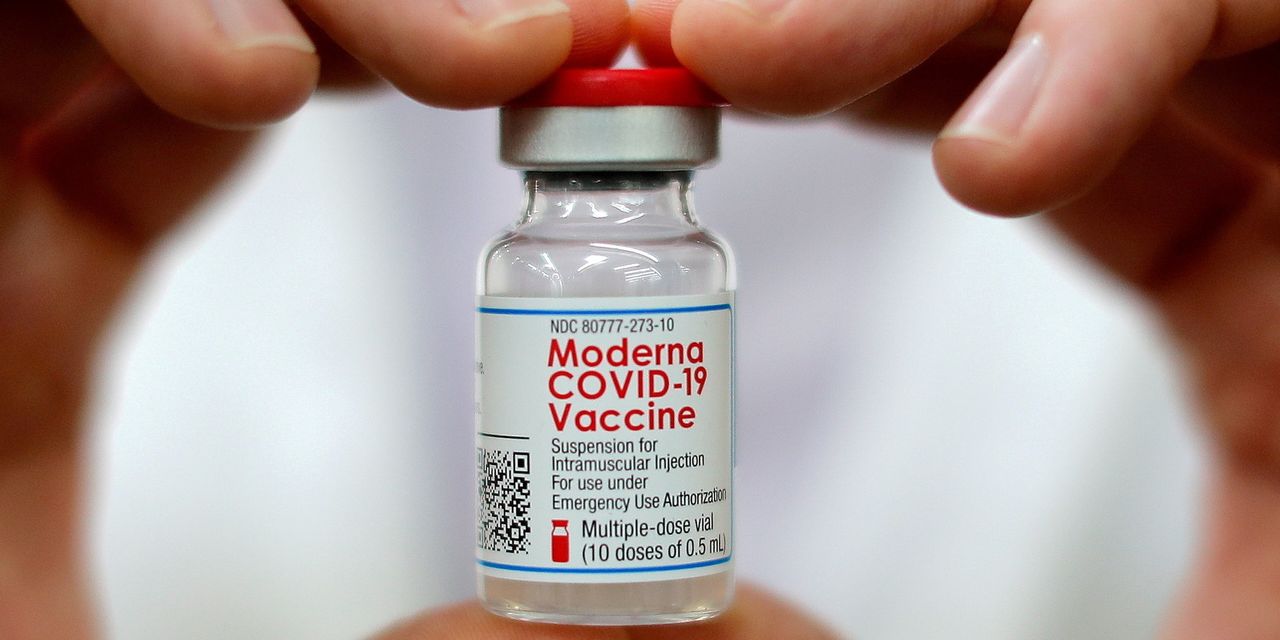

- Vaccine makers stated they had been assembling groups of scientists to assess the brand new Omicron pressure of Covid. Moderna climbed 9.7% premarket, Johnson & Johnson nudged up 0.5%, Pfizer gained 1.3% and Novavax added 4.1%.

- New Covid restrictions are rattling the journey trade once more, though airways stated the busy Thanksgiving weekend usually went easily. Southwest Airways rose 1.3% premarket, Delta Air Strains gained 2.5% and American Airways climbed 2.3%.

- Cruise traces had been additionally recovering from a few of their massive declines final week, with Carnival up 4% premarket and Royal Caribbean up 3.3%.

- Crude costs had been additionally clawing again a few of final week’s drop, and vitality producers had been climbing. Occidental Petroleum gained 3.7%, Devon Power rose 2.8% and Diamondback Power rose 2%. Oil-services firm Halliburton was up 2.9%.

- Zoom Video Communications obtained a bit enhance final week as traders thought of the prospect of an prolonged interval of distant work. That commerce was partially reversing early Monday, with the inventory down 2.1%.

- Bitcoin was additionally on the rise, up 5.8% from its Friday 5 p.m. ET worth to $57,240.35. Coinbase shares gained 3.4%, and bitcoin miners Marathon Digital and Hut 8 Mining gained 5.6% and 5% respectively.

Chart of the Day

- Non-public-equity companies have introduced a document $944.4 billion price of buyouts within the U.S. thus far this yr, greater than double the quantity of the earlier peak in 2007.

Write to James Willhite at james.willhite@wsj.com