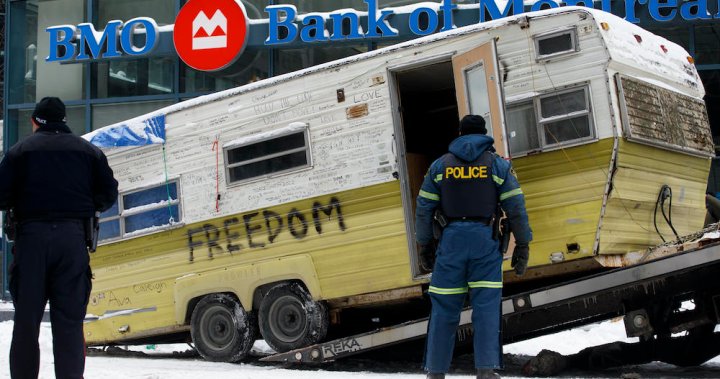

When the so-called “freedom convoy” pivoted to Bitcoin and different digital property as a supply of funds when conventional channels had been lower off, Canadian authorities ratcheted up makes an attempt to police the cryptocurrency house.

Now, with the convoy’s blockades cleared and a few of these monetary pressures stress-free, persevering with efforts to recoup crypto from organizers are going through technological hurdles.

The contemporary consideration on crypto laws started when convoy organizers, lower off from funds raised by way of GoFundMe and different crowdfunding platforms, turned to Bitcoin (BTC) and different blockchain-based property to fund their ongoing blockades. Some organizer estimates pegged the whole BTC raised at roughly $1 million in equal Canadian {dollars}.

When the Liberal authorities invoked the Emergencies Act, the unprecedented transfer included language directing monetary establishments — together with crypto exchanges — to freeze accounts linked to the protests.

Learn extra:

Ottawa’s Emergencies Act cracks down on convoy crypto. Consultants warn that’s not straightforward

Although in style myths surrounding cryptocurrencies would possibly label the rising digital property as secretive and untraceable, in Canada the place laws on crypto exchanges have been in place for years, consultants say the framework to trace down and crack down on the motion of cryptocurrency is already in place.

“I do know within the early days of Bitcoin, a standard argument was, ‘Bitcoin is only for terrorists as a result of it’s simply obfuscated they usually can conceal behind the scenes,’” says Michael Vogel, CEO of Vancouver-based crypto alternate Coinstream.

“Effectively, the irony is, really each single Bitcoin transaction is recorded completely.”

That perpetual monetary document is a pure characteristic of the blockchain, the decentralized ledger that underpins cryptocurrencies, non-fungible tokens (NFTs) and a slew of different rising, high-tech makes use of.

Whereas the identities of customers on the blockchain will be disguised, the Bitcoin foreign money system is just “pseudo nameless,” Vogel says.

Although cryptocurrency will be exchanged user-to-user advert nauseum, in an effort to convert it right into a extra useable fiat foreign money, crypto homeowners should undergo an alternate, like Coinstream.

In Canada, all crypto exchanges are registered with FINTRAC, the nation’s major monetary watchdog. Among the many necessities for working legally in Canada, then, are getting fundamental figuring out particulars in regards to the alternate’s customers.

Learn extra:

Cryptocurrency fraud ‘exploding’ in Canada, based on client advocacy teams

By way of these “on and off ramps,” Vogel says, Canadian authorities can pin down how crypto is flowing to folks of curiosity within the “freedom convoy” or actually every other operation underpinned by the digital foreign money.

This degree of regulation is helpful to the exchanges as effectively, Vogel says, as crypto platforms additionally discover themselves the targets of fraud regularly.

“So it’s really a symbiotic relationship the place, going via a strategy of realizing your clients and onboarding them and getting their ID once they join, it does assist lower down on fraud and and in instances of prison investigations, it helps present a line of sight into what’s occurring,” he says.

Whereas a federal finance official confirmed Tuesday that financial institution accounts associated to the protest are starting to be unfrozen, that doesn’t imply convoy crypto is within the clear.

Organizers had been slapped with one other authorized lock on their funds final Thursday, by way of a uncommon courtroom order filed by lawyer Paul Champ on behalf of a non-public group of Ottawa residents and enterprise homeowners looking for compensation for the weeks of disruptive demonstrations within the metropolis’s core.

The Mareva Injunction, because it’s identified, names numerous banks, crowdfunding platforms, crypto exchanges and digital foreign money holders and an inventory of crypto wallets and accounts related to the convoy.

The injunction calls on these corporations to freeze the motion of any funds from the required wallets throughout their platforms as a part of an total order to stop key organizers from liquidating their property — thereby making certain the category motion lawsuit, if profitable, has funds to recoup.

It’s believed to be the primary time in Canadian historical past a Mareva Injunction has been used to freeze crypto property.

Bitbuy, a Toronto-based crypto alternate named within the order, confirmed to International Information that it’s ready to freeze any property coming in from the blacklisted accounts on its platform.

Joseph Iuso, the chief anti-money laundering officer at Bitbuy, says that the traceable factor of crypto could make it much less engaging for illicit actions than even conventional fiat foreign money.

“I believe something that places a highlight on crypto however doesn’t put a highlight on the opposite kinds of funds and funding fashions might be just a little bit overblown. On the finish of the day, each methodology of cost, each methodology of having the ability to switch cash can be utilized and exploited by the prison factor,” he says.

“I imply, if we need to discuss evil instruments, money! Money is essentially the most nameless factor on the earth.”

Issues with accessing funds

However even with the crypto regime effectively regulated in Canada, there are some facets of the expertise that make it tough to exert management.

One of many convoy organizers, No person Caribou (recognized as Nicholas St. Louis within the injunction), stated in a current interview with Bitcoin Journal that 80 per cent of the funds raised in Bitcoin had been being consolidated into wallets offered by Nunchuk.io.

The corporate, named alongside Bitbuy and different crypto exchanges within the Mareva Injunction, posted a public assertion on Twitter rebuking the very nature of the order.

The corporate stated that it isn’t, because the order appeared to recommend, a crypto alternate with custodial privileges over its customers’ crypto wallets.

Whereas exchanges like Coinstream and Bitbuy, that are registered with FINTRAC, have vital private particulars about their customers, Nunchuk is a software program developer that makes an app for customers to host their very own crypto wallets. The corporate says it merely has e-mail addresses for its shoppers, nothing extra.

Nunchuk isn’t a center man that facilitates transactions for its shoppers, thereby giving it no management over the sending of funds and even particular information of what exercise occurs in its clients’ wallets.

“Please search for how self custody and personal keys work,” the assertion, addressed to the Ontario Superior Court docket of Justice, learn. “When the Canadian greenback turns into nugatory, we will likely be right here to serve you, too.”

Cryptocurrency consultants who spoke to International Information largely agreed with Nunchuk’s evaluation.

Charlene Cieslik, chief compliance officer of Toronto-based Bitcoin ATM-maker Localcoin, stated in an e-mail to International Information that asking Nunchuk to police the cryptocurrency in wallets hosted on its software program could be “tantamount to asking Louis Vuitton to observe my leather-based pockets as soon as I depart the shop.”

“They’re a self-custody pockets — they’re not not aware about any info like exchanges. All they may block is the e-mail, however you may get one other e-mail and one other pockets supplier. They’re merely not protecting the information wanted to dam,” she wrote.

Champ advised International Information in an emailed assertion Wednesday that even when Nunchuk doesn’t have the power to freeze property, different necessities below the Mareva Injunction may nonetheless apply to the corporate.

“If the middleman doesn’t have the power to freeze the property, the order nonetheless requires them to reveal any info they’ve about any property which can be held by the respondents,” Champ stated.

“We’re reviewing this explicit response from Nunchuk and can deal with it, if crucial earlier than the courtroom.”

— with information from International Information’ Anne Gaviola

© 2022 International Information, a division of Corus Leisure Inc.