While many businesses are struggling to stay afloat during the Covid-19 pandemic, some industries have been fortunate enough to remain on an even keel. This includes companies that depend on the steady inflow of goods into Singapore to transport and sell them.

One of these businesses is B&S Services hauling company, which was launched by Mr Mohd Noor Mohd Salim, 34, affectionately called Bai, just as Covid-19 started to gather pace. The venture is clearly a labour of love (he named it after the initials of his nickname and his wife’s name, Suzie), and definitely not a foolhardy move.

Mr Mohd Noor has been in the hauling trade since 2007, which means he was already very familiar with this business of first-mile transport. While last-mile delivery services bring goods to their purchasers, first-mile hauliers transport goods from locations such as ports to destinations such as warehouses, where they are then processed for further distribution. Clients for such hauling companies include freight consolidators, which combine multiple shipments of goods for delivery to a common location.

Mr Mohd Noor extensively discussed the pros and cons of starting his own business, during a global crisis, with his wife. Ultimately, two factors pushed him into taking the bold plunge. Over the years, the affable man had developed strong relationships with a network of clients. He recalls: “They said they would support me 100 per cent if I started my own business.” And they stuck to their word. “Every single one of these clients is still with me,” he adds, also sharing that he has worked out an amicable agreement with his past employer to service these clients.

The second push factor was the assurance he received from digital haulage service provider Haulio, founded by Mr Sebastian Shen, a tech consultant, and Mr Alvin Ea, who is a logistics entrepreneur. The duo understood the pain points and inefficiencies of the industry and assured Mr Mohd Noor that Haulio would support his entrepreneurship journey with the right digital solutions. “I consulted them about everything,” says Mr Mohd Noor. “They gave me the courage to start the business. Without them, I wouldn’t have this company.”

Despite having this support, 2020 was still a daunting time to go out on his own. As China shut its borders to control the spread of Covid-19, shipments of goods to and from the country dwindled. That meant fewer goods for B&S’ freight consolidator clients and less work for the fledgling hauling company.

During this time, Mr Mohd Noor turned to Haulio’s job pool marketplace, which lists trucking jobs within PSA’s ports and those posted by businesses that need containers moved. Like ride-hailing platforms, this marketplace allows registered hauliers to see available trucking jobs and respond to the ones that best suit their fleet schedule. Thanks to trucking jobs booked through this digital marketplace, B&S stayed solidly in the black throughout 2020, and the platform still accounts for well over half of the company’s trucking jobs.

Cash flow problems

Another challenge many entrepreneurs faced last year was the uncertain business environment, which often led to cash flow issues. This was the case for Mr Rick Chee, a 43-year-old produce retailer who had started his business, Fruityd, in 2018. Before the onset of Covid-19, he had had a one-month credit term with his suppliers. But as the pandemic dragged on, these suppliers began asking to be paid cash upon delivery. This meant that their cash flow issues effectively became an issue for him as well.

Mr Chee had done his homework before setting up his business, by working in the fruits department of a supermarket for a year and a half to learn the ropes and build up a network of suppliers. During this self-directed apprenticeship period, he figured out how to stretch the shelf life of fruits by selling them over three different stages – from whole fruit to cut fruit and finally, fruit juice.

While the cash flow problem was an unexpected hurdle, he took a proactive approach, and decided to apply for invoice financing from trade and logistics services firm, Global eTrade Services (GeTS). It has a platform that leverages data to assess if businesses qualify for financing.

Being able to access this financing enabled Mr Chee to strengthen his cash flow position, allowing him to be more proactive about selecting his suppliers. In the past, he was only able to work with suppliers who agreed to give him a one-month credit term. The ability to pay cash upon delivery has made a wider range of suppliers available to him and puts him in a better negotiating position.

“I can compare prices from more suppliers now and ask for lower prices because I can offer them cash upon delivery,” says Mr Chee. “So, having stronger cash flow is definitely an advantage.”

Drive to digitalise

Since the retail outlets where his produce is sold were allowed to stay open throughout the pandemic, Mr Chee’s business remained stable. In fact, his sales in 2020 went up by about 20 per cent, compared to 2019. He took advantage of this to test the waters of e-commerce, selling fruits via Carousell and Facebook Marketplace, and gathered useful insights into possible ways to grow this aspect of his operations.

Another company making strategic strides in digitalisation during this period is 40-year-old trucking company Thong Lee, which switched to a new digital communications platform to manage its operations more effectively.

Ensuring its 30 truckers know where to go to pick up cargo and keeping track of its fleet day to day is the crux of success for this business. In the 80s, Thong Lee’s controllers did this using pagers and walkie-talkies. Later, mobile data terminals were installed in its trucks, “but the drivers needed to slow down just to scroll and read the messages on the screen”, explains Mr Thomas Chang, Thong Lee’s general manager.

These terminals were eventually replaced by an electronic system installed on dedicated tablets. Both software and hardware were new to Thong Lee’s drivers, who were mostly in their 50s and 60s. Mr Chang says: “We had to spend a lot of time convincing them not to be afraid of the new technology and help them get used to this system.”

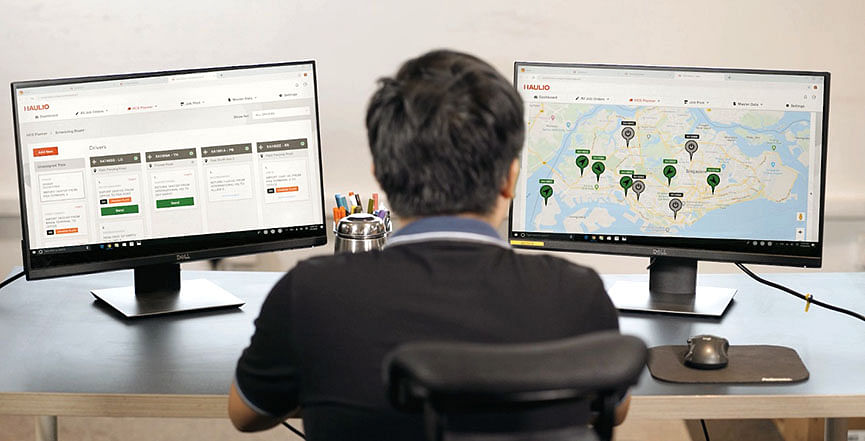

Last January, Thong Lee decided to cut over to the Haulio Community System (HCS), a platform that enables crucial tasks such as fleet management, vehicle routing and real-time job status tracking to take place digitally. This system can be used on tablets as well as smartphones. The drivers found it more user-friendly and received help adjusting to the new platform.

Haulio co-founder Mr Shen says: “We often meet resistance from elderly drivers in terms of learning a new digital tool for work. Our team conducts in-person training sessions, provides onboarding guides in English and Mandarin, and takes drivers’ feedback into account as it iterates the product. For instance, the option to view the HCS interface in Mandarin and larger text sizes are direct results of responding to suggestions from older drivers.”

The 2021 switch to a digital communications platform followed on the heels of many adjustments for Thong Lee’s drivers during 2020, including switching to cashless payment methods such as Giro to sort out fees like depot handling charges. Under normal working conditions, these fees are paid in cash at the depots by drivers, who then make regular trips to Thong Lee’s office to be reimbursed in cash. This became untenable due to Covid-19 safety precautions, and getting drivers used to cashless refunds addresses only a small part of a larger pain point that transcends the pandemic – the fact that so many depot operators still require processing charges to be paid in cash.

Some operators are starting to transition to a cashless system, and SMEs such as Thong Lee and B&S show that smaller companies can be more agile in embracing digital solutions that resolve longstanding inefficiencies in the sector. In 2007, for instance, Mr Mohd Noor was still using sheets of paper “the size of a 32-inch TV” to track information such as vehicle numbers and export dates. “There was a lot of printing, stapling, and highlighting going on,” he says of that analogue mode of operations. “You had to finish your job in the office.” He switched to Google Sheets as soon as that became viable and now runs B&S using digital solutions such as HCS.

Going digital has served these businesses well. From $15,000 and the single rented truck Mr Mohd Noor started the company with, B&S has added one fully-owned truck and three more rented ones to its fleet.

Recognising pain points in the supply chain ecosystem, such as the lack of data sharing, and the prevalence of manual processes, the Alliance for Action (AfA) on Supply Chain Digitalisation saw the need to accelerate digitalisation in these areas, including logistics and finance (see below, Emerging Stronger Together).

Mr Mohd Noor hopes that the time and resources spent on digitalisation over the past year will stand his company in good stead as the world starts to move towards a post-pandemic landscape. “I want to expand,” he says. “I think more companies will open, and a larger volume of goods will start coming in after the pandemic.”

Already, he’s fielding more client calls and channelling excess business to Haulio’s jobs marketplace. To realise his expansion ambitions, he will need more drivers, and they will need to embrace digital ways. “Sometimes you have to pressure them a bit,” he says affectionately of the older, more-resistant drivers. “But once they get used to the technology, it’s easy.”

This is the final part of a series on the resilience of Singaporeans, as they band together to seize new opportunities in a world changed by Covid-19.

In partnership with the Emerging Stronger Taskforce.