TOKYO—Chinese language authorities accredited U.S. chip maker

Superior Micro Gadgets Inc.’s

deliberate $35 billion buy of

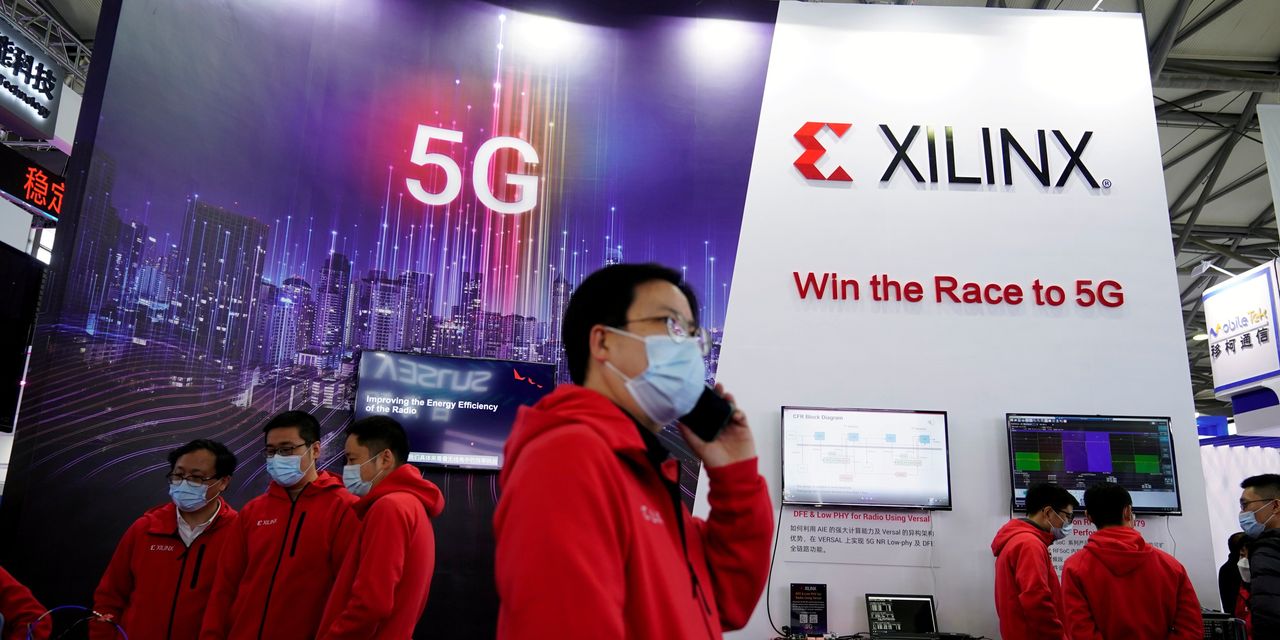

Xilinx Inc.,

clearing the final main regulatory hurdle for one of many greatest offers in recent times within the semiconductor trade.

China’s State Administration for Market Regulation mentioned in an announcement launched on-line Thursday that it has conditionally accredited the deal, which AMD and Xilinx had reached in October 2020. The 2 corporations had already acquired approvals from competitors authorities in main markets besides China, an AMD govt informed analysts in December.

AMD and Xilinx didn’t instantly reply to requests for remark.

AMD’s addition of San Jose, Calif.-based Xilinx, which focuses on a sort of chip known as field-programmable gate arrays, would put AMD, based mostly in Santa Clara, Calif., on a extra even keel with rival

Intel Corp.

, which additionally has a FPGA enterprise acquired from Altera in 2015.

Xilinx and Intel are the dominant makers of FPGA, which could be reprogrammed after they’re made. FPGA are sometimes utilized in 5G telecommunications infrastructure, navy communications and radar programs. AMD focuses on central-processing models and graphics chips utilized in computer systems.

The approval comes weeks after AMD and Xilinx mentioned they might push again the shut date of the deal to the primary quarter of this yr from end-2021, as they couldn’t safe crucial approvals.

The Chinese language antitrust regulator mentioned in an announcement that it’s requiring the merged entity to take care of or develop investments into R&D actions in China for core applied sciences. The merged entity should promote to Chinese language clients on truthful, affordable and nondiscriminatory phrases, it additionally mentioned. These situations would apply for at the least six years, and the merged entity should report back to authorities each six months on these commitments, the regulator mentioned.

China’s antitrust authority, which has broad attain to say say over offers wherein at the least one occasion has a major presence within the Chinese language market, has performed a key position in some semiconductor offers in recent times.

Final month, Intel acquired the inexperienced mild from the Chinese language regulator for the $9 billion sale of its flash-memory chip enterprise to South Korea’s

SK Hynix Inc.,

clearing the final hurdle for that deal.

In 2018,

Qualcomm Inc.

scrapped its $44 billion deliberate acquisition of

NXP Semiconductors

NV after ready for an approval from Chinese language authorities, which didn’t are available time.

Write to Yang Jie at jie.yang@wsj.com

Corrections & Amplifications

Xilinx Inc. is predicated in San Jose, Calif. A headline to an earlier model of this text incorrectly mentioned it was a Chinese language firm. (Corrected on Jan. 27)

Copyright ©2022 Dow Jones & Firm, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8