SINGAPORE – Analysts who cover Keppel Corp have given the company’s offer to privatise the non-media assets of Singapore Press Holdings (SPH) nods of approval, with most upgrading their target valuations for Keppel to above $6.

Shares of Keppel closed on Tuesday (Aug 3) at $5.45.

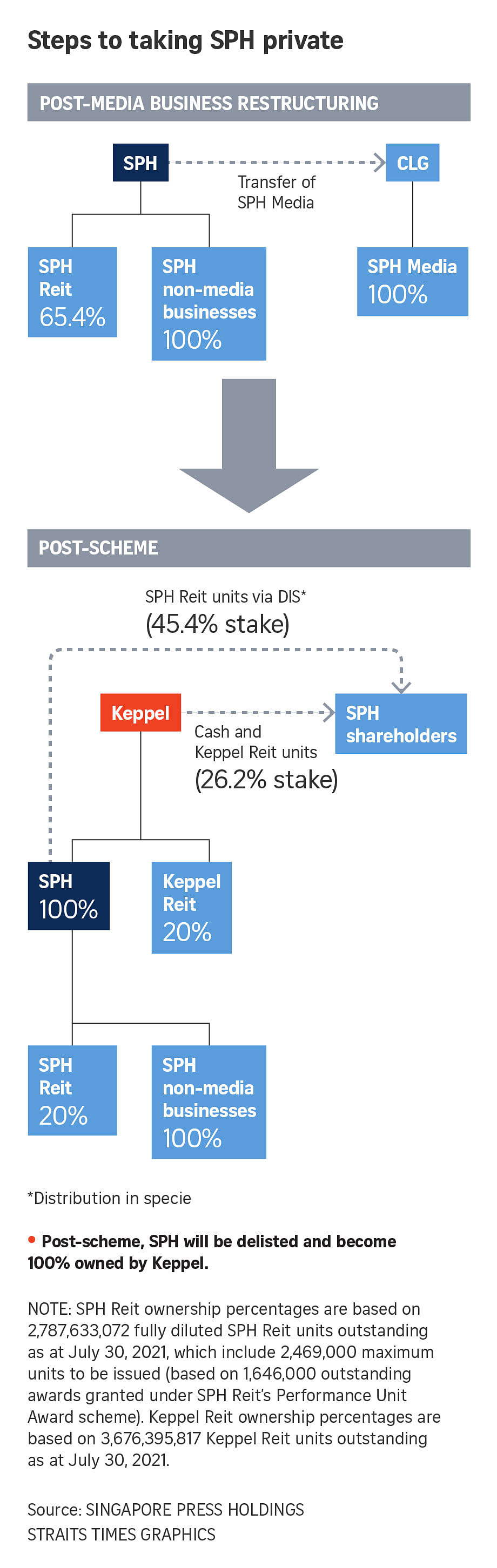

Keppel on Monday offered to acquire SPH after the company hives off its media business. If approved by SPH shareholders, the restructuring of the media business is expected to be completed by the end of the year. Keppel’s offer, if also approved by regulators and shareholders, will be concluded soon after.

In exchange for 100 per cent of SPH’s non-media assets, Keppel’s total outlay will amount to $2.2 billion, comprising $1.08 billion in cash and the remainder in units of Keppel Reit.

As part of the transaction, SPH will concurrently distribute 45 per cent of its stake in SPH Reit to its shareholders and retain 20 per cent of the Reit units. This will form part of the acquisition by Keppel.

SPH Reit holds the Paragon shopping mall in Orchard Road, while Keppel Reit has interests in prime office properties such as Marina Bay Financial Centre and Ocean Financial Centre.

The implied consideration for each SPH share is $2.099, representing an 11.6 per cent premium to SPH’s last traded price of $1.88 a share on July 30.

Keppel chief executive Loh Chin Hua said the acquisition is a “rare opportunity”, adding that there is a “very natural fit” between SPH’s businesses and three of Keppel’s four focus businesses, namely asset management, urban development and connectivity. The fourth is energy and environment.

Mr Loh said the SPH acquisition will “immediately enhance Keppel’s returns as well as the quality of Keppel’s earnings profile”.

With the addition of SPH Reit, Keppel Capital’s assets under management could potentially grow by 27 per cent to $47 billion. Keppel will also gain entry into the purpose-built student accommodation sector and expansion in the senior living sector.

Macquarie Research analyst Foo Zhi Wei noted that the acquisition will not stretch Keppel financially.

Keppel recently offloaded $2.3 billion worth of assets as part of a programme announced last September. Half of these transactions have since been completed, netting the company $1.15 billion in cash between October 2020 and end June.

At Keppel’s recent results briefing, Mr Loh also said the company expects to divest $5 billion worth of assets by 2023.

CGS-CIMB analyst Lim Siew Khee expects Keppel to offload up to $1.1 billion worth of non-core SPH assets following an acquisition, leading to attractive dividends in future.

While noting that “the deal looks good on paper”, Mr Foo said that execution of the deal is key.

“Despite Keppel’s deep expertise and skill, they are not infallible. Not all the assets it acquires may be successfully spun off at higher value”. Still, he added that Keppel is not likely to “lose money” for its investors.

UOB Kay Hian analysts Adrian Loh and Lucas Teng believe SPH shareholders should accept the Keppel offer, saying that the offer price of $2.099 “appears to be fair”.

“In our view, the most appealing aspect of SPH’s portfolio, excluding media, is its student accommodation assets”, they said, adding that similar assets are increasingly sought after given their resilience to the economic impact of Covid-19, due to a rising domestic student population.