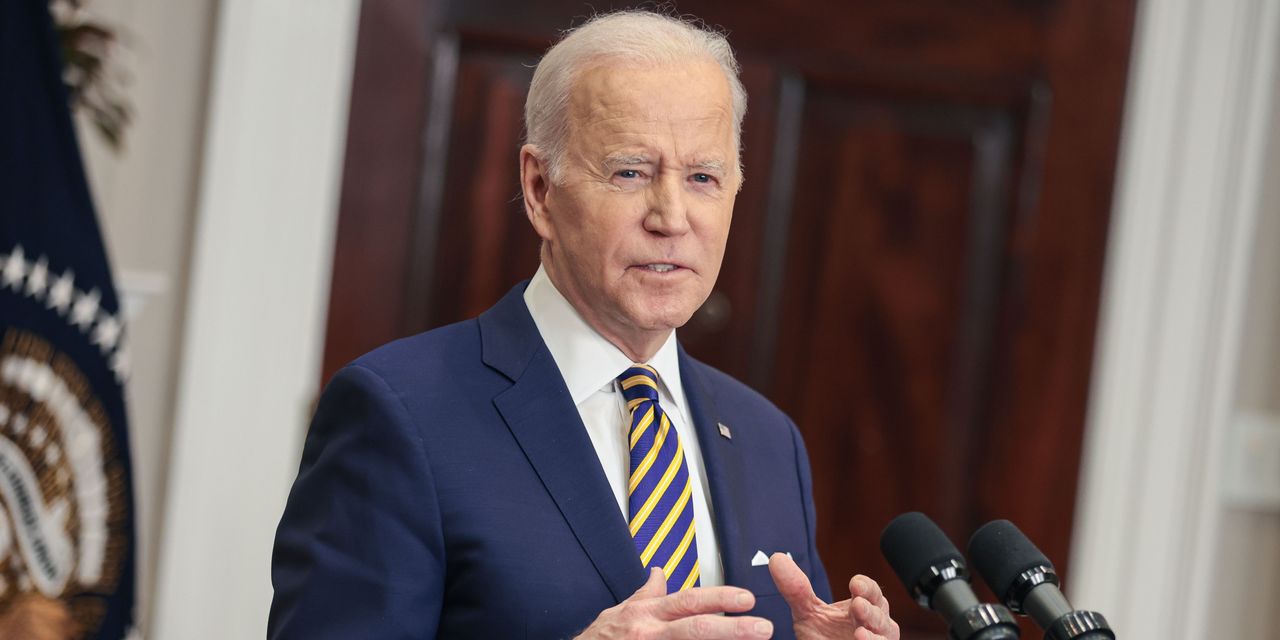

WASHINGTON—President Biden will signal an government order on Wednesday instructing companies throughout the federal authorities to review the attainable dangers introduced by the explosion in recognition of cryptocurrencies and take into account the creation of a U.S. digital foreign money.

The manager order will urge federal regulators to assessment the dangers a roughly $1.75 trillion crypto market presents to shoppers, buyers and the broader economic system. Federal companies can have a number of months to arrange a report with their findings, which can then inform any new regulatory actions the White Home takes, a senior administration official mentioned.

About 16% of grownup Individuals, or roughly 40 million individuals, have invested in, traded or used cryptocurrencies, based on a White Home truth sheet. That rising prevalence of digital belongings, which embrace risky cryptocurrencies like bitcoin and so-called stablecoins pegged to belongings just like the U.S. greenback, has pushed the Biden administration to centralize its work on the subject. White Home officers have been working with the crypto trade and specialists for a number of months to arrange the chief order.

“This isn’t a distinct segment problem anymore, and it’s profoundly necessary that we’ve got the suitable instruments to mitigate the dangers to shoppers and to buyers and admittedly to your entire monetary system,” a senior administration official mentioned.

Bitcoin’s greenback worth jumped greater than 9% from its 5 p.m. ET degree Tuesday to $42,118.73 on Wednesday, based on CoinDesk. A lot of the climb got here earlier than the formal announcement of the White Home’s plans, after the Treasury Division by chance revealed an announcement on the chief order from Treasury Secretary

Janet Yellen.

Ms. Yellen mentioned the president’s order will help accountable innovation in digital belongings whereas additionally addressing dangers associated to illicit finance. The assertion was taken down after being revealed in error, a Treasury spokeswoman mentioned, and was later reposted Wednesday morning.

Issues over stricter regulation could have weighed on bitcoin’s worth, mentioned Chris Bendiksen, head of analysis at London-based asset-management agency

CoinShares.

“It might be that there’s been this overhanging worry of some unfavorable motion by the U.S. authorities,” he mentioned.

Beneath the chief order, the Biden administration will scrutinize how cryptocurrencies could undercut U.S. sanctions and efforts to combat cash laundering, a senior administration official mentioned. These issues have been heightened because the U.S. has leveled sanctions on Russia in response to its invasion of Ukraine. The administration can even examine the influence that energy-intensive crypto mining has on the local weather.

The Biden administration can even formally take into account the creation of a attainable U.S. digital foreign money, a cryptocurrency backed by the Federal Reserve, based on a White Home truth sheet. The Federal Reserve is already evaluating the opportunity of a digital foreign money, which another nations, together with China, have already adopted. An individual accustomed to the matter mentioned the chief order will ask the Justice Division to review whether or not Congress would wish to authorize the creation of a digital foreign money.

Whereas in some ways a broad, preliminary assessment, the White Home government order opens the door to extra substantial federal regulation in a sector that companies have beforehand largely sidestepped or addressed piecemeal.

—Caitlin Ostroff contributed to this text.

Write to Andrew Duehren at andrew.duehren@wsj.com

Copyright ©2022 Dow Jones & Firm, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8