Credit Suisse

CS -2.40%

Group AG and

SoftBank

9984 -0.80%

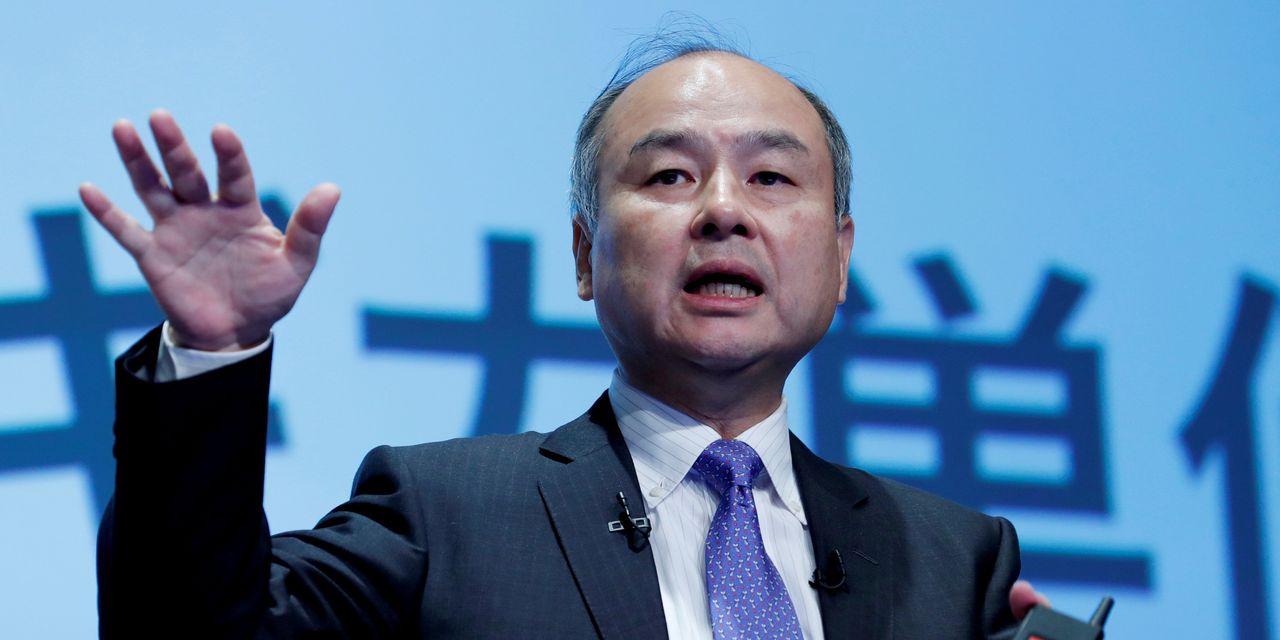

Group Corp. Chief Executive

Masayoshi Son

recently dissolved a longstanding personal lending relationship and the bank clamped down on transactions with his company, according to regulatory filings and people familiar with the matter.

The moves came after the collapse of SoftBank-backed Greensill Capital in March plunged

Credit Suisse

CS -2.40%

into turmoil. It also follows Credit Suisse’s $5.5 billion loss stemming from trading by family office Archegos Capital Management. The bank has since promised to dial down risk.

Mr. Son had long used Credit Suisse and other banks to borrow money against the value of his substantial holdings in SoftBank. As recently as February, Mr. Son had around $3 billion of his shares in the company pledged as collateral with Credit Suisse, one of the biggest amounts of any bank, according to Japanese securities filings. The share pledge loan relationship stretched back almost 20 years. By May, that lending had gone to zero.

Mr. Son still maintains substantial share pledges with a handful of other banks, according to the filings. It couldn’t be learned who initiated the ending of the share pledges with Credit Suisse.

A SoftBank spokesperson declined to comment.

Credit Suisse also moved to curtail its relationship with SoftBank as a corporate customer, according to the people familiar with the matter. Credit Suisse now requires any business involving SoftBank to go through additional layers of risk checks and approvals, amounting to an informal ban on new business, the people said.

SHARE YOUR THOUGHTS

What lingering effects do you see coming from Credit Suisse reducing its business with SoftBank? Join the conversation below.

The Japanese conglomerate invests in dozens of technology companies around the world and is one of the most prolific sources of deals and loans for Wall Street banks. Its holdings span the tech world, from ride hailing, through

Uber Technologies Inc.,

to drug developers and chip designers. It has had major stumbles as well, including office landlord WeWork.

Credit Suisse has worked as financial adviser to SoftBank and companies backed by its $100 billion Vision Fund. It competes with other banks to take those companies public or raise other financing, according to regulatory filings and deal announcements.

In many ways, SoftBank and Mr. Son are the exact type of clients Credit Suisse targets. The bank aims to parlay personal lending to rich entrepreneurs into bigger, more lucrative deals from their corporate holdings.

The relationship has strained in recent months over the Greensill collapse, according to the people familiar with the matter. Bloomberg News reported in May that Credit Suisse wouldn’t do any new business with SoftBank.

Trouble surfaced in the summer of 2020 when Credit Suisse executives reviewed potential conflicts of interest around $10 billion of investment funds the bank ran with Greensill.

An investment by SoftBank in one of the Credit Suisse funds essentially made the Japanese company both a lender and a borrower, since other companies it invested in also received financing. SoftBank redeemed its investment after the review and Credit Suisse said it was committed to protecting investors.

Credit Suisse froze the Greensill funds in March when the financing firm lost a key type of credit insurance backing up the funds. The freeze plunged Greensill into bankruptcy and left Credit Suisse scraping to recover money on behalf of the funds’ investors, including pension funds and corporate treasurers.

Credit Suisse has said it is working to recover the money and so far has gotten back more than half of investors’ $10 billion in capital.

Some of that recovery is focused on companies backed by SoftBank, including construction technology firm Katerra. It owed $440 million to the Credit Suisse funds.

When Katerra ran into financial difficulties last year, Greensill forgave the loan, The Wall Street Journal previously reported. SoftBank, in turn, invested $440 million into Greensill, expecting the money to go to Credit Suisse fund investors.

Instead, Greensill put the proceeds of the SoftBank investment in a bank it owned in Bremen, Germany, according to a bankruptcy administrator’s report. The report said Greensill had used money it received from SoftBank, including the $440 million, to boost its bank’s capital position and fund Greensill’s overall operations.

Much of Mr. Son’s vast personal wealth stems from his nearly 30% stake in SoftBank. Forbes currently lists him as neck-and-neck with

Tadashi Yanai,

founder of Asia’s top clothing retailer, Fast Retailing Co., for the title of Japan’s richest man, with a net worth of around $35 billion.

The brash Mr. Son has always been a big risk taker, say people who have known him for years. He invests aggressively in a variety of ventures and often uses his shares to secure loans, one of the people said. Over the years, Mr. Son has bought a number of pricey houses in Tokyo, including one he equipped with an indoor golf range that could simulate weather conditions like rain.

In 2012, he paid $117 million for a mansion near billionaire

Larry Ellison’s

place in Woodside, Calif.—at the time the most ever paid for a house in the U.S. In recent years, he has also personally invested billions of dollars in the Vision Fund.

Mr. Son and related vehicles reduced their total SoftBank shares pledged from 271 million to 197 million between February and May, according to the filings. His other share-based lenders include

Nomura Holdings Inc.,

UBS Group AG and

Mizuho Financial Group Inc.,

according to filings.

In March of last year, the proportion of Mr. Son’s SoftBank holdings pledged as collateral grew as high as 72%, as SoftBank’s share price plummeted and banks called for more collateral.

The Japanese tech conglomerate’s shares have tripled in price since, and Mr. Son is now pledging just below 40% of his total SoftBank holdings as collateral, the filings show, suggesting any squeeze on his assets has been relieved.

Write to Margot Patrick at margot.patrick@wsj.com and Phred Dvorak at phred.dvorak@wsj.com

Copyright ©2020 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8