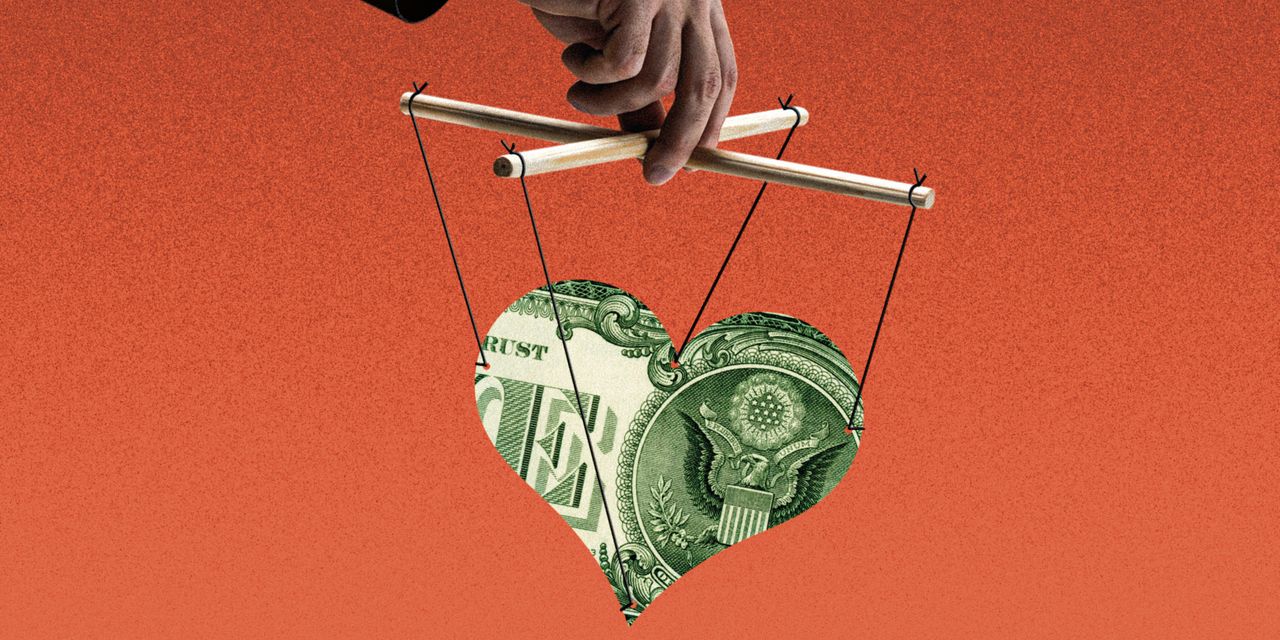

Insider trading catches regulators’ attention and garners headlines, but another type of insider activity is also widespread—and far less likely to be detected or prosecuted.

That’s the conclusion of new research that looks into the practice of insider giving: timing the donation of a stock to a charity around inside information about the stock. That way, you take a tax deduction before bad news sends the share price tumbling or after good news sends the price higher—and the gift delivers a bigger deduction than you would have gotten otherwise.

Insider giving is “worryingly widespread” among large shareholders, or those who hold 10% or more of a company’s shares, according to the study by Cindy Schipani, professor of business law at the University of Michigan’s Ross Business School, and Nejat Seyhun, professor of finance at the school.

In many cases, insiders benefited from large share-price moves. In the year before large shareholders made their gifts, the stocks they donated rose about 6% on average. The year after donations, those stocks dropped about 4% on average, according to the professors and their co-authors, Sureyya Burcu Avci, lecturer and visiting researcher at Istanbul’s Sabanci University Business School, and Andrew Verstein, professor of law at the University of California, Los Angeles, Law School.

These “suspiciously well-timed” donations “suggest more than chance,” says Mr. Seyhun. “The fact that large shareholders can determine or choose—with pinpoint accuracy—the average maximum price over a two-year period when they give gifts is surprising,” he says.