SINGAPORE (THE BUSINESS TIMES) – Keppel Infrastructure Trust (KIT) has entered into a conditional agreement to acquire the remaining 30 per cent stake it does not already own in SingSpring Desalination Plant from Hyflux for $12 million, KIT’s trustee manager announced on Wednesday (July 7).

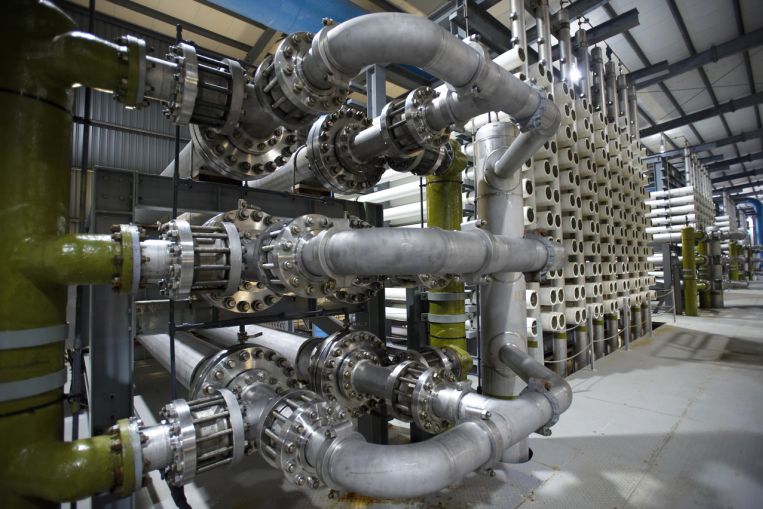

The facility in Tuas is Singapore’s first large-scale seawater desalination plant and can supply up to 136,380 cubic metres of desalinated potable water per day. It began commercial operations in December 2005, and utilises cost- and energy-efficient reverse osmosis technology.

Then, it was the largest membrane-based seawater desalination plant in the world with one of the largest reverse osmosis trains.

Presently, KIT owns 70 per cent of the plant and will buy the remaining 30 per cent from the insolvent Hyflux.

Mr Jopy Chiang, chief executive-designate of trustee manager Keppel Infrastructure Fund Management, said the acquisition “will enhance the operational and business continuity… and also strengthen the cash flow stability of the asset”.

“This is an opportunity to increase our stake in a stable asset at a level which is expected to be accretive to distribution per unit and offer an attractive risk-adjusted return for KIT.”

The acquisition is not expected to have any material financial impact on the distribution per unit of KIT for the financial year ending December 2021.

NewSpring O&M, a unit of Keppel Infrastructure Holdings, will take over the provision of operation and maintenance services to the plant upon completion of the acquisition.

The current operations and maintenance team will be offered the opportunity to continue their roles and duties to facilitate a smooth transition.

Keppel Infrastructure Holdings is the sponsor of KIT.

The acquisition is subject to approvals from national water agency PUB and lenders under a term loan facility taken up by the trustee for SingSpring Trust.

The counter closed unchanged at $0.555 on Wednesday, before the announcement was made.