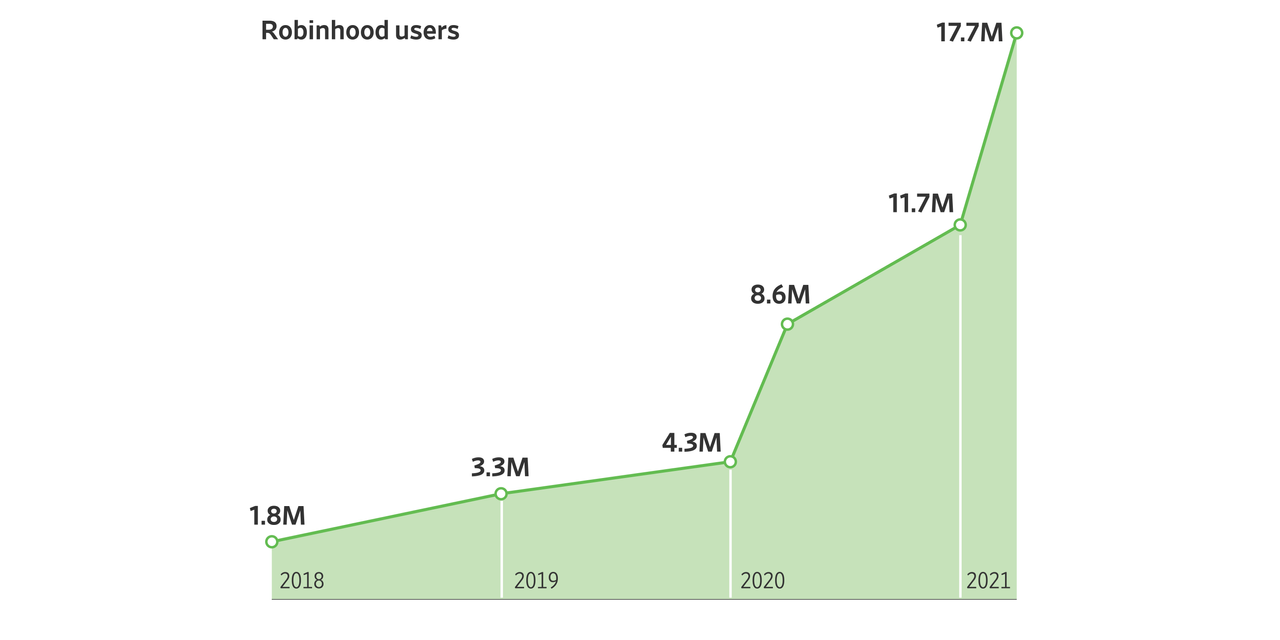

Robinhood Markets Inc. is urging its users to invest in its eagerly awaited initial public offering, setting aside as much as 35% of the shares being sold for individuals to buy. And like other companies going public, the trading-app company laid out in its prospectus certain risk factors associated with its business that it thinks investors should be aware of before buying in.

Some of those factors are tied to something IPO investors look for—explosive growth. Growth can bode well for potential future profits but, as the company points out in its regulatory filing, it remains to be seen how successfully it can sustain and manage that growth.

“We have grown rapidly in recent years and we have limited operating experience at our current scale of operations. If we are unable to manage our growth effectively, our financial performance may suffer and our brand and company culture may be harmed.”

—COMPANY FILING

Robinhood’s assets under custody

“We have grown rapidly in recent years and we have limited operating experience at our current scale of operations. If we are unable to manage our growth effectively, our financial performance may suffer and our brand and company culture may be harmed.”

—COMPANY FILING

Robinhood’s assets under custody

“We have grown rapidly in recent years and we have limited operating experience at our current scale of operations. If we are unable to manage our growth effectively, our financial performance may suffer and our brand and company culture may be harmed.”

—COMPANY FILING

Robinhood’s assets under custody

Robinhood’s assets under custody

“We have grown rapidly in recent years and we have limited operating experience at our current scale of operations. If we are unable to manage our growth effectively, our financial performance may suffer and our brand and company culture may be harmed.”

—COMPANY FILING

Robinhood’s assets under custody

“We have grown rapidly in recent years and we have limited operating experience at our current scale of operations. If we are unable to manage our growth effectively, our financial performance may suffer and our brand and company culture may be harmed.”

—COMPANY FILING

Robinhood was caught unprepared last year by a spike in trading volume when stocks were crashing early in the pandemic, which led to repeated outages during a volatile time for markets.

Earlier this year, Robinhood again was blindsided by a spike in popularity during the thick of the trading frenzy surrounding

GameStop Corp.

and other so-called meme stocks. When the capital required as a risk cushion rose by billions of dollars, Robinhood was forced to get emergency financing. It also temporarily halted trading in some of the most in-demand stocks, which damaged its reputation.

Part of Robinhood’s popularity was that it was at the forefront of a push to make investing more affordable with zero-commission trades. Its business model instead relies more heavily on revenue from payment for order flow, a practice in which high-speed trading firms pay brokerages for the right to execute orders. That practice has been around for decades but has faced new scrutiny by regulators in the wake of the GameStop frenzy. Robinhood attributed 81% of its first-quarter revenue to such transactions.

Payments to Robinhood for order flow, 1Q 2021

Citadel Securities

paid Robinhood

$90 million for

options trades

and $52 million

for stock trades

Payments for

options trades

Wolverine

Execution Services

Payments for

stock trades

*Excludes revenue from cryptocurrency trades.

“For the three months ended March 31, 2021, 59% of our total revenues came from four market makers. If any of these market makers…were unwilling to continue to receive orders from us or to pay us for those orders (including, for example, as a result of unusually high volatility), we may have little to no recourse.”

—COMPANY FILING

Payments to Robinhood for order flow, 1Q 2021

Citadel Securities

paid Robinhood

$90 million for

options trades

and $52 million

for stock trades

Payments for

options trades

Wolverine

Execution Services

Payments for

stock trades

*Excludes revenue from cryptocurrency trades.

“For the three months ended March 31, 2021, 59% of our total revenues came from four market makers. If any of these market makers…were unwilling to continue to receive orders from us or to pay us for those orders (including, for example, as a result of unusually high volatility), we may have little to no recourse.”

—COMPANY FILING

Payments to Robinhood for order flow, 1Q 2021

Citadel Securities

paid Robinhood

$90 million for

options trades

and $52 million

for stock trades

Payments for

options trades

Wolverine

Execution Services

Payments for

stock trades

*Excludes revenue from cryptocurrency trades.

“For the three months ended March 31, 2021, 59% of our total revenues came from four market makers. If any of these market makers…were unwilling to continue to receive orders from us or to pay us for those orders (including, for example, as a result of unusually high volatility), we may have little to no recourse.”

—COMPANY FILING

Payments to Robinhood for order flow, 1Q 2021

Citadel

Securities

paid Robinhood

$90 million

for options

trades and

$52 million

for stock

trades

Wolverine

Execution

Services

*Excludes revenue from cryptocurrency trades.

“For the three months ended March 31, 2021, 59% of our total revenues came from four market makers. If any of these market makers…were unwilling to continue to receive orders from us or to pay us for those orders (including, for example, as a result of unusually high volatility), we may have little to no recourse.”

—COMPANY FILING

Payments to Robinhood

for order flow, 1Q 2021

Citadel

Securities

paid Robinhood

$90 million

for options

trades and

$52 million

for stock

trades

Wolverine

Execution

Services

*Excludes revenue from cryptocurrency trades.

“For the three months ended March 31, 2021, 59% of our total revenues came from four market makers. If any of these market makers…were unwilling to continue to receive orders from us or to pay us for those orders (including, for example, as a result of unusually high volatility), we may have little to no recourse.”

—COMPANY FILING

Robinhood is hardly alone in its reliance on payment for order flow. It represents a significant source of revenue for other brokerages like E*Trade and

Charles Schwab Corp.

, which completed its acquisition of TD Ameritrade last year. But those firms are often part of much larger companies or have more diverse sources of revenue.

Payment-for-order-flow revenue in 2020, select brokerages

“Because a majority of our revenue is transaction-based (including payment for order flow, or “PFOF”)…any new regulation of, or any bans on, PFOF…may result in reduced profitability, increased compliance costs and expanded potential for negative publicity.”

—COMPANY FILING

Charles Schwab

$1.4 billion

Apex Clearing $ 25 million

Payment-for-order-flow revenue in 2020, select brokerages

“Because a majority of our revenue is transaction-based (including payment for order flow, or “PFOF”)…any new regulation of, or any bans on, PFOF…may result in reduced profitability, increased compliance costs and expanded potential for negative publicity.”

—COMPANY FILING

Charles Schwab

$1.4 billion

Apex Clearing $ 25 million

Payment-for-order-flow revenue in 2020, select brokerages

“Because a majority of our revenue is transaction-based (including payment for order flow, or “PFOF”)…any new regulation of, or any bans on, PFOF…may result in reduced profitability, increased compliance costs and expanded potential for negative publicity.”

—COMPANY FILING

Charles Schwab

$1.4 billion

Apex Clearing $ 25 million

Payment-for-order-flow revenue in 2020,

select brokerages

Charles Schwab

$1.4 billion

Apex Clearing $ 25 million

“Because a majority of our revenue is transaction-based (including payment for order flow, or “PFOF”)…any new regulation of, or any bans on, PFOF…may result in reduced profitability, increased compliance costs and expanded potential for negative publicity.”

—COMPANY FILING

Payment-for-order-flow revenue in 2020,

select brokerages

Charles Schwab

$1.4 billion

Apex Clearing $ 25 million

“Because a majority of our revenue is transaction-based (including payment for order flow, or “PFOF”)…any new regulation of, or any bans on, PFOF…may result in reduced profitability, increased compliance costs and expanded potential for negative publicity.”

—COMPANY FILING

Robinhood reported a $1.4 billion first-quarter loss that was due in part to the emergency fundraising. Even before the loss, the company had been struggling to sustain profitability.

“We have incurred operating losses in the past and may not maintain profitability in the future.”

—COMPANY FILING

“We have incurred operating losses in the past and may not maintain profitability in the future.”

—COMPANY FILING

“We have incurred operating losses in the past and may not maintain profitability in the future.”

—COMPANY FILING

“We have incurred operating losses in the past and may not maintain profitability in the future.”

—COMPANY FILING

“We have incurred operating losses in the past and may not maintain profitability in the future.”

—COMPANY FILING

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8