Monetary specialists and former diplomats say the chances vary from sanctions on the nation to hitting Putin’s associates.

The Biden administration has loads of choices to make good on its pledge to hit Russia financially if President Vladimir Putin invades Ukraine, from sanctions concentrating on Putin’s associates to chopping Russia off from the monetary system that sends cash flowing world wide.

The US and European allies have made no public point out of any plans to reply militarily themselves if Putin sends troops massed alongside the border into Ukraine, a former Soviet republic with shut historic and cultural ties to Russia however now desperate to ally with NATO and the West.

As a substitute, payback may very well be all concerning the cash.

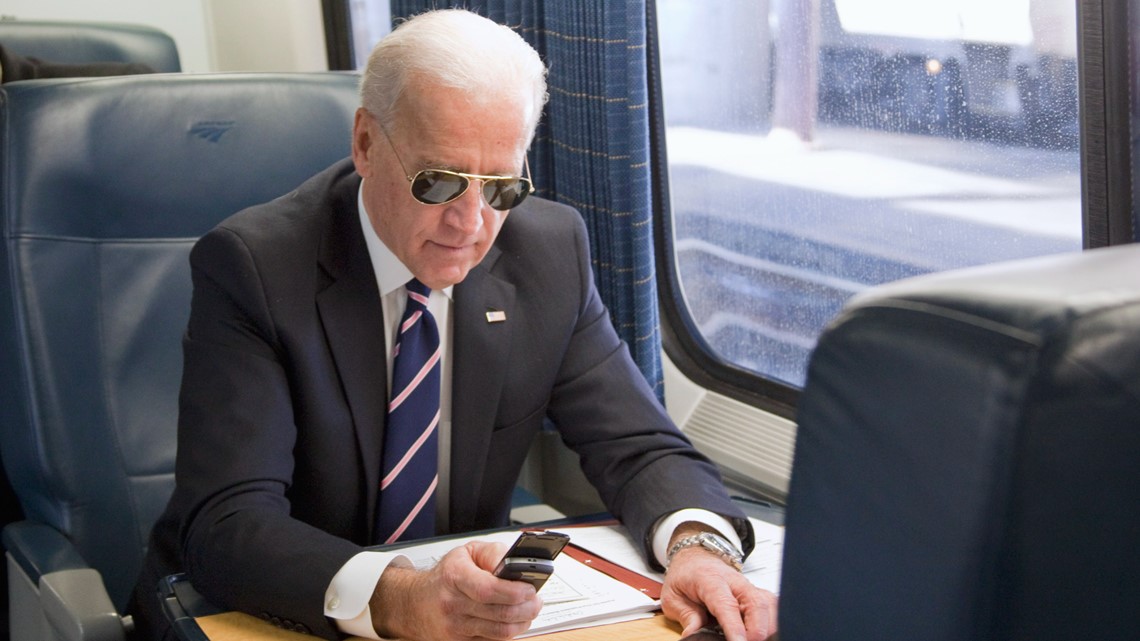

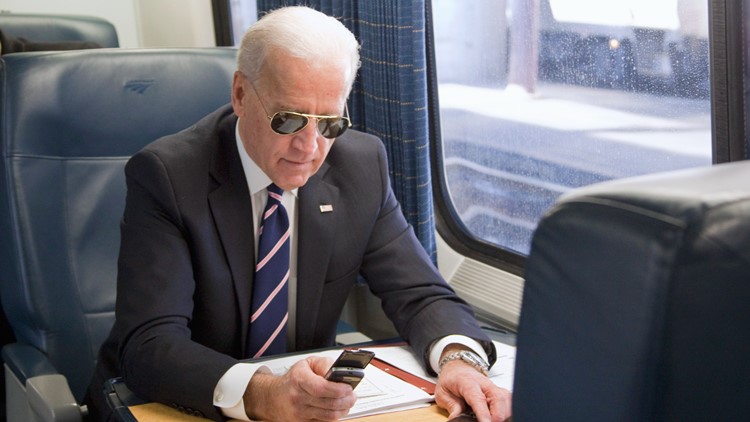

Secretary of State Antony Blinken this week promised monetary ache — “excessive influence financial measures that we have kept away from taking prior to now.” President Joe Biden on Friday mentioned the U.S. had developed the “most complete and significant set of initiatives to make it very, very tough for Mr. Putin.”

The US over the previous decade already has put a spread of sanctions in place in opposition to Russian entities and people, a lot of them over Russia’s invasion and annexation of Crimea and its assist for armed separatists in japanese Ukraine in 2014. U.S. sanctions even have sought to punish Russia for election interference, malicious cyber actions and human rights abuses.

Since 2014, the West additionally has helped Ukraine construct up its navy. So whereas Putin denies any intention of launching an offensive, his troops would face a Ukrainian military far more able to placing up a combat.

The sanctions now imposed on Russians embrace asset freezes, bans on doing enterprise with U.S. firms and denial of entry to america. However in in search of to punish Russia, the West over time has weighed even larger monetary penalties.

That features the so-called nuclear possibility: blocking Russia from the Belgium-based SWIFT system of economic funds that strikes cash amongst 1000’s of banks world wide.

The European Parliament this 12 months permitted a nonbinding decision calling for that step if Russia does invade Ukraine.

When the U.S. efficiently pressured SWIFT to disconnect Iranian banks over Iran’s nuclear program, the nation misplaced nearly half of its oil export income and a 3rd of its international commerce, mentioned Maria Shagina, an professional on sanctions and vitality politics affiliated with the Carnegie Moscow Heart suppose tank.

The influence on Russia’s financial system could be “equally devastating,” Shagina writes. Russia depends upon its oil and pure gasoline exports for greater than one-third of its federal revenues, and depends upon SWIFT to make the petrodollars stream.

Russia has labored since 2014 to insulate its home monetary methods from such a cutoff. A SWIFT cutoff would trigger oblique ache for Western economies as properly.

John Herbst, a former U.S. ambassador to Ukraine and profession diplomat, mentioned Friday he believed that whereas “SWIFT isn’t off the desk, it will be a final resort.”

The Biden administration earlier this 12 months additional restricted Russia’s potential to borrow cash by banning U.S. monetary establishments from shopping for Russian authorities bonds immediately from state establishments. However the sanctions did not goal the secondary market, leaving this as a doable subsequent step.

Different doable instruments and targets, Herbst famous: monetary sanctions concentrating on folks near Putin and their households; and extra sanctions on Russian banks and on Russia’s very important vitality sector.