TOKYO—After a deal that would have been price $80 billion to his firm fell aside,

SoftBank Group Corp.

Chief Government

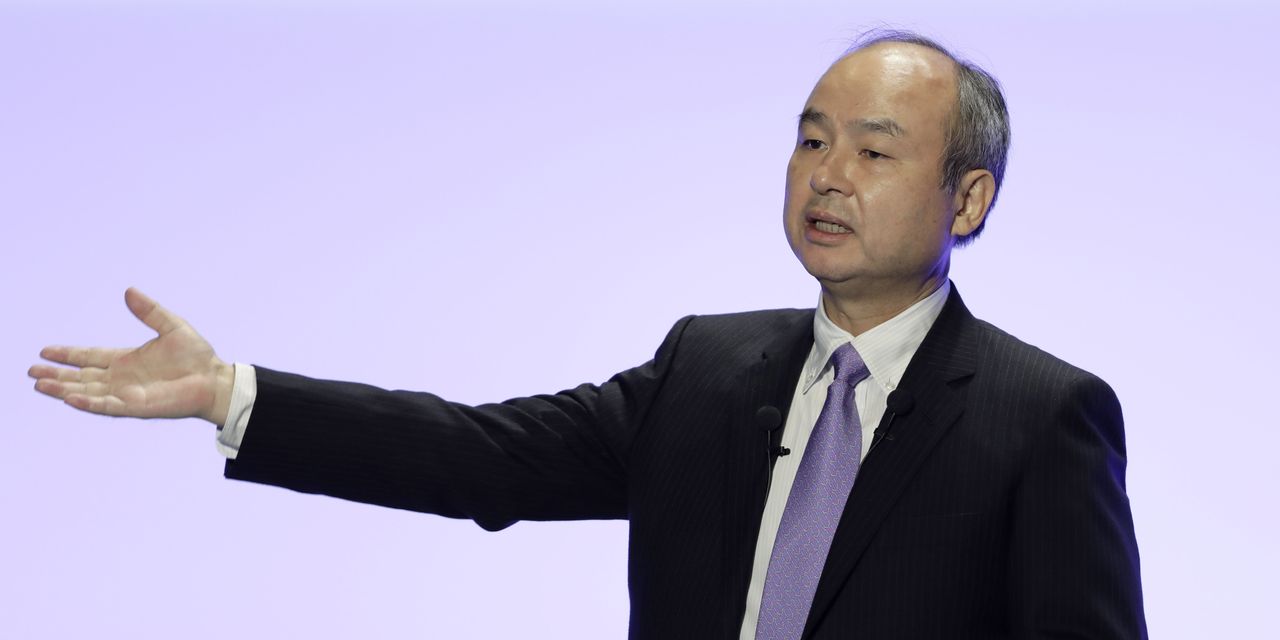

Masayoshi Son

is taking part in salesman for Plan B—an preliminary public providing of chip designer Arm.

Mr. Son sounded as if he have been on a roadshow for buyers at a information convention in Tokyo on Tuesday. He mentioned Arm is coming into a “golden interval” of excessive demand for the chips it helps create in smartphones, electrical autos and computer-server farms operated by the likes of

Amazon.com Inc.

The pitch got here hours after the Japanese funding and expertise conglomerate mentioned it was abandoning plans to promote Arm to

Nvidia Corp.

—in what would have been the biggest semiconductor deal on file—as a result of antitrust considerations stood in the way in which.

Mr. Son mentioned he was stunned to see the backlash not solely from U.S. regulators who sued to dam the deal in December but in addition large tech firms that depend on Arm’s chip designs.

“We noticed robust opposition as a result of Arm is among the most necessary and important firms that almost all firms within the IT business or in Silicon Valley depend on, both instantly or not directly,” he mentioned.

SoftBank paid $32 billion when it acquired the U.Okay.-based chip enterprise in 2016. Mr. Son mentioned the sale to Nvidia, beneath which SoftBank would have acquired each money and Nvidia shares, may have been price $80 billion due to an increase in Nvidia’s share worth.

SoftBank now plans to pursue a public itemizing of Arm by March 2023. Arm shares will most definitely be listed on the tech-heavy

Nasdaq Inventory Market

within the U.S. as a result of lots of Arm’s purchasers are based mostly in Silicon Valley, Mr. Son mentioned.

He mentioned SoftBank didn’t intend to maintain Arm for itself as a result of he needed exterior buyers within the SoftBank-led Imaginative and prescient Fund, which owns 1 / 4 of Arm, to have the ability to money in by means of an IPO and since he needed to present inventory choices as incentives to Arm staff.

Uncertainties linger round an Arm IPO, together with whether or not the unstable semiconductor enterprise will keep scorching by means of this 12 months.

Tech shares have fallen lately due to tightening by the Federal Reserve. Fumio Matsumoto, chief strategist at

Okasan Securities,

mentioned that made the timing for an enormous IPO lower than superb, and he additionally noticed {that a} strategic purchaser within the chip business would possibly pay extra for Arm due to the potential synergy results.

Nonetheless, Mr. Matsumoto mentioned the downturn in Silicon Valley additionally supplied alternatives for Mr. Son, and it made sense to lift money for his conflict chest from an Arm IPO. “As a result of expertise share costs have gone by means of a pointy correction over the previous 12 months, we’re seeing a very good cycle to contemplate making ready” for brand spanking new investments, Mr. Matsumoto mentioned.

After a tough patch just a few years in the past, Arm is on monitor for $2.5 billion in income this fiscal 12 months, which ends in March, up from $1.98 billion the earlier 12 months, SoftBank mentioned. Arm’s working revenue, in response to one kind of calculation utilized by SoftBank, greater than doubled over the previous two years to a projected $900 million this fiscal 12 months.

An array of shopper electronics firms in addition to semiconductor firms, together with

Apple Inc.,

Samsung Electronics Co.

and

Qualcomm Inc.,

use Arm’s designs in not less than a few of their chips. The designs are recognized for his or her low energy consumption, making them almost ubiquitous in cell units.

The collapse of the Arm deal is simply one of many challenges Mr. Son is tackling in his globe-spanning funding portfolio. He mentioned “we’re in ache” over China’s crackdown on its large tech firms, which hit SoftBank investments together with its most respected one, e-commerce large

Alibaba Group Holding Ltd.

The previous two years have seen a number of the wildest swings within the 4 many years since Mr. Son began SoftBank. The pandemic, initially seen as a blow, quickly emerged as a boon for a lot of expertise companies together with these through which SoftBank has invested. SoftBank shares surged, solely to fall by half from their current peak when the China troubles hit and the Arm deal ran aground.

SoftBank’s web asset worth, Mr. Son’s most well-liked measure of the corporate’s funds, fell by ¥1.6 trillion, equal to about $14 billion, within the October-December quarter to ¥19.3 trillion. That could be a fall of 30% from the height in September 2020 and the bottom degree since 2017.

Mr. Son blamed the sharp fall in Alibaba shares. The Chinese language firm, which as soon as made up the vast majority of SoftBank’s web property, now accounts for lower than 1 / 4 of the full.

SoftBank mentioned it unloaded a small variety of Alibaba shares to settle contracts with its lenders, however Mr. Son mentioned SoftBank’s stake within the Chinese language firm remained near 1 / 4.

Mr. Son, who turns 65 this 12 months, has misplaced quite a lot of high lieutenants in recent times, together with Chief Working Officer

Marcelo Claure,

who stepped down in January after a pay dispute. Mr. Son mentioned that whereas he was grooming successors, he didn’t intend to step down quickly.

“If I cease, I’d grow to be an previous grandpa in a short time,” he mentioned. He boasted that when he went bowling lately, he topped 200 factors in two completely different rounds—a high quality rating for an newbie. “I assumed, ‘Hey, I’m nonetheless fairly younger,’ ” he mentioned.

—Sam Schechner in Paris contributed to this text.

Write to Megumi Fujikawa at megumi.fujikawa@wsj.com and Peter Landers at peter.landers@wsj.com

Copyright ©2022 Dow Jones & Firm, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8