BENGALURU (BLOOMBERG) – Snapdeal, the Indian on-line retailer backed by SoftBank Group and Alibaba Group Holding, plans to file preliminary paperwork for an preliminary public providing of as a lot as US$250 million (S$341 million) within the subsequent few weeks, in keeping with folks aware of the matter.

The e-commerce large goals to go public in early 2022 after submitting the draft purple herring prospectus, or DRHP, the folks mentioned, asking to not be recognized speaking a couple of non-public matter.

Snapdeal, as soon as thought-about the fiercest rival to Amazon.com and Walmart’s Flipkart on the earth’s fastest-growing main on-line enviornment, plans to boost not less than US$200 million at a US$1.5 billion valuation, they added.

The corporate did not instantly present touch upon its submitting plans or different monetary particulars.

Snapdeal, which caters primarily to the fast-growing phase of smaller-city customers considerably uncared for by bigger rivals, would turn out to be the biggest tech firm to check traders’ urge for food for IPOs after the disastrous debut of Paytm’s guardian, One 97 Communications.

The fintech large has misplaced about 20 per cent of its share worth since its debut on Nov 18. Snapdeal had thought-about elevating about US$400 million at a valuation of as much as US$2.5 billion, Bloomberg Information reported in September. It is now hoping as an alternative to duplicate the sturdy showings of fellow on-line commerce corporations like meals supply platform Zomato and wonder retailer FSN E-Commerce Ventures, which owns Nykaa.

Snapdeal’s largest shareholders, which additionally embody BlackRock, Temasek Holdings and EBay, should not promoting shares, the folks mentioned.

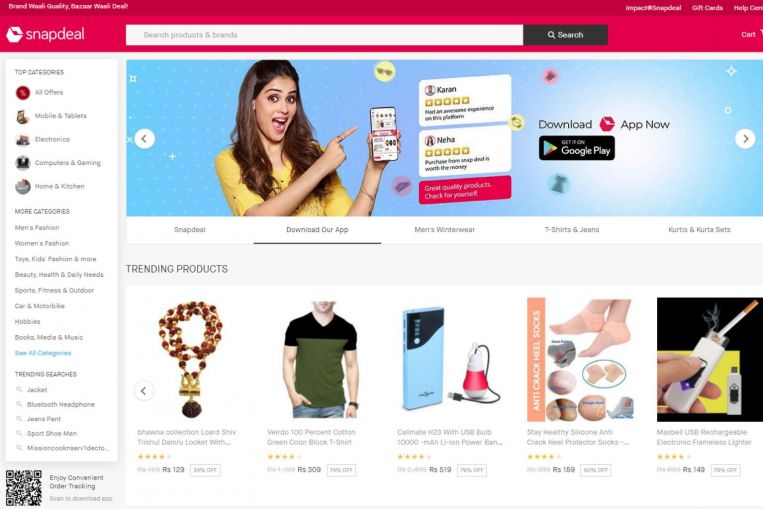

The beginning-up co-founded by Wharton alumnus Kunal Bahl in 2010 focuses on the less-affluent and fewer tech-savvy bulk of the inhabitants dwelling outdoors India’s greatest cities. It bucks the development set by Amazon and Flipkart by not catering to big-city consumers and eschewing big-ticket gadgets like high-priced electronics.

It emerged as one of many nation’s main e-commerce suppliers however misplaced floor to its bigger rivals. In 2017, it backed away from a possible merger with Flipkart that will have united the two local-e-commerce firms towards Amazon, a deal that SoftBank had pushed for. The Japanese investor then rotated to steer a funding spherical for arch-rival Flipkart.

Since then, Walmart purchased a controlling stake in Flipkart, which is now progressing towards its personal IPO. And newer entrants reminiscent of Mukesh Ambani’s Reliance conglomerate threaten to additional disrupt the business.

Snapdeal will observe a clutch of Indian firms pushing to boost greater than US$1 billion mixed from IPOs in December.

Warburg Pincus-backed pharmacy chain MedPlus Well being Providers and Healthium Medtech, a maker of surgical devices managed by buyout agency Apax Companions, are amongst itemizing hopefuls aiming to promote shares subsequent month, in keeping with folks with data of the matter. Others embody Shriram Properties and wedding-apparel maker Vedant Fashions.