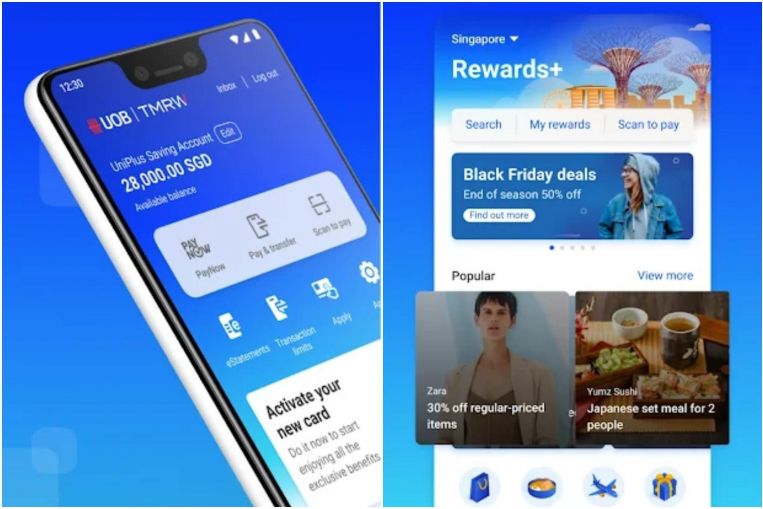

SINGAPORE – UOB is partnering smart payment fintech platform Fave to launch a new rewards programme, the bank’s first initiative under its new unified digital platform, UOB TMRW.

The alliance with Fave will bring together two major rewards and loyalty programmes in a move that aims to add value to the shopping experience, said Ms Jacquelyn Tan, UOB head of group personal financial services.

Both customers and merchants stand to gain, as this will result in double the number of business locations under the UOB Rewards+ programme, making it the largest rewards programme in Singapore.

Customers will be able to enjoy a wider array of shopping options as well as savings when they pay for exclusive deals from merchants with their credit card reward points on UOB TMRW.

Meanwhile, merchants participating in the programme, many of which are heartland mom-and-pop shops, will receive help in connecting with more customers and moving their payment systems online, said Ms Tan.

In what UOB says is a first for the region, customers can also track through UOB TMRW the amount of credit card reward points they earn with every purchase. This is an improvement from the traditional banking rewards experience, which provides consumers a summarised view of their consolidated rewards points and makes it difficult for them to reconcile their spending with the amount of rewards points earned, UOB said.

The UOB Rewards+ programme also taps the bank’s proprietary digital engagement engine, which uses artificial intelligence (AI), machine learning and data analytics to personalise the reward experience for each customer.

For example, UOB is able to learn from the customer’s transaction and reward redemption patterns when recommending relevant deals.

Ms Tan said the bank’s aim is to make banking simpler, transparent and engaging for all UOB customers.

“Consumers in Singapore want more clarity, such as the 87 per cent of respondents in our market research who want a breakdown of the rewards points they have accumulated,” she said.

The move comes a month after the bank said it would invest up to $500 million over the next five years to scale up its digital offerings in Singapore and the rest of Asean.

It also aims to double the retail customers it serves digitally to more than seven million.